Credit_Risk_Analysis

Supervised Machine Learning and Credit Risk Analysis.

Overview of the loan prediction risk analysis:

Credit risk is an inherently unbalanced classification problem, as good loans easily outnumber risky loans. Different techniques were used to train and evaluate models with unbalanced classes. Various libraries and algorithms were used to build and evaluate models using resampling including:

- imbalanced-learn

- scikit-learn

Over Sampling Techniques with Linear Regression Model

- RandomOverSampler

- SMOTE algorithms

Under sampling Technique with Linear Regression Model

- ClusterCentroids algorithm

Combination of Over- and Under- Sampling with Linear Regression Model

- SMOTEENN algorithm

Bias Reduction Models

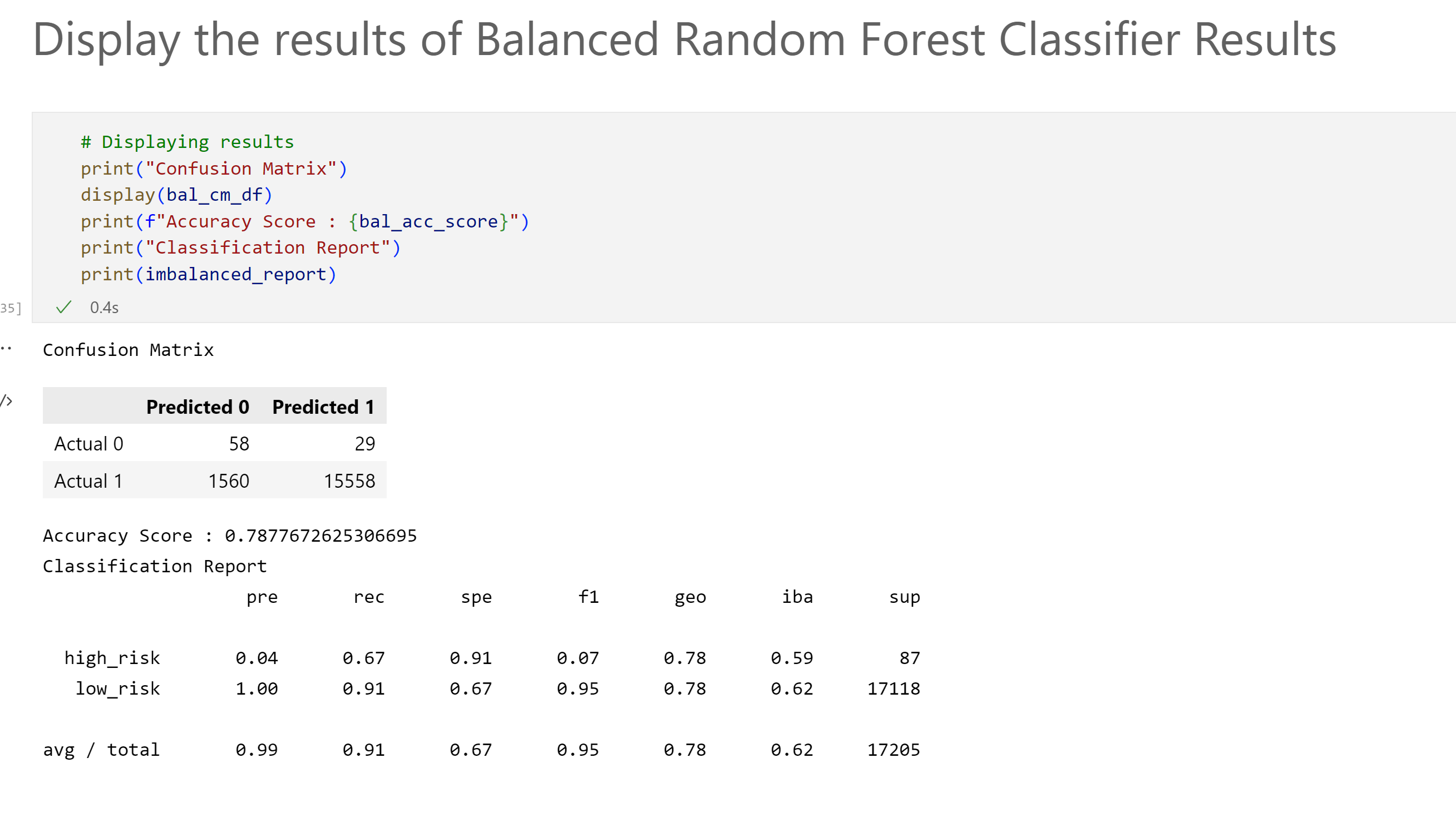

- BalancedRandomForestClassifier

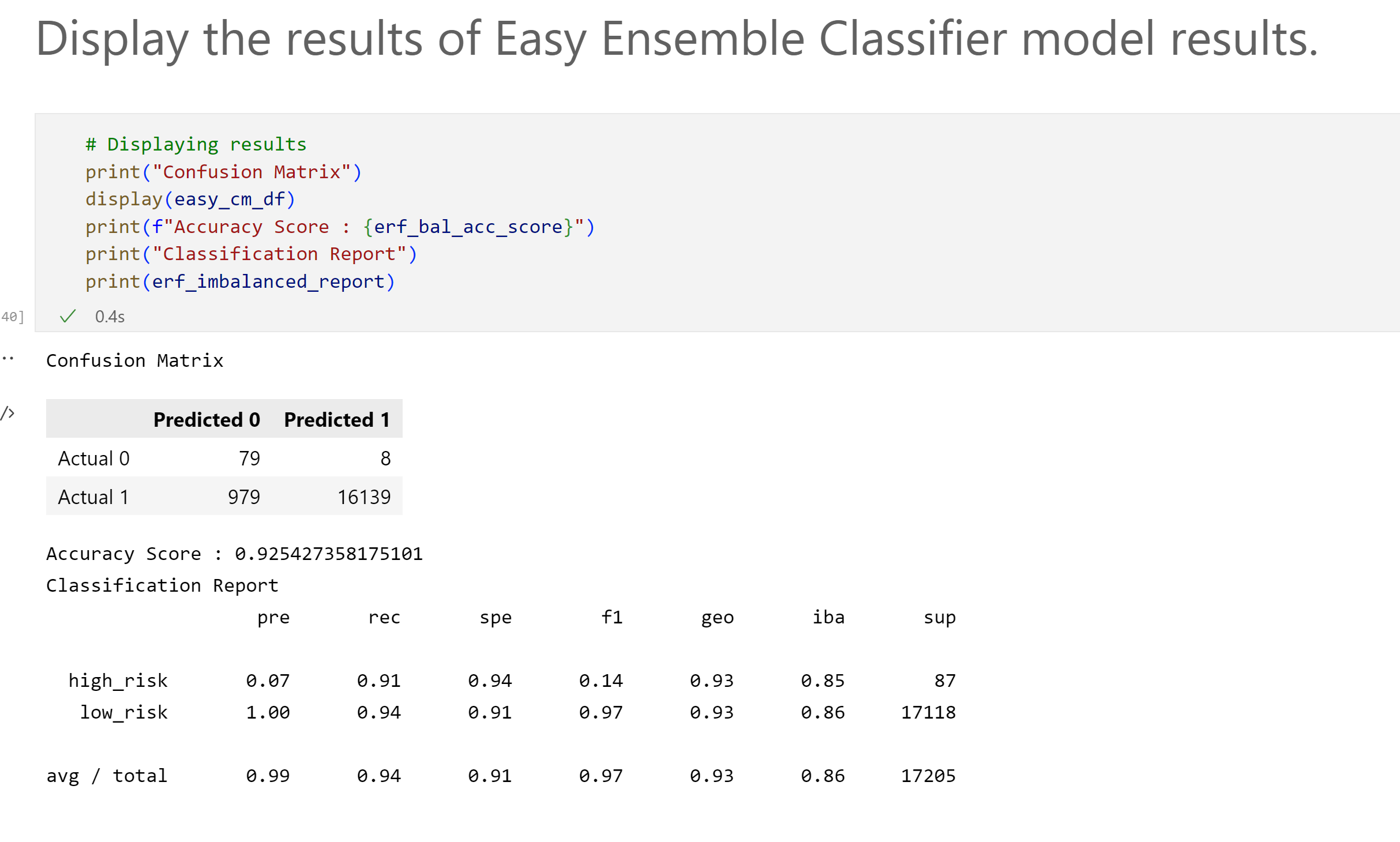

- EasyEnsembleClassifier

Background:

Using the credit card credit dataset from LendingClub, a peer-to-peer lending services company, you’ll oversample the data using the RandomOverSampler and SMOTE algorithms, and undersample the data using the ClusterCentroids algorithm. Then, you’ll use a combinatorial approach of over- and undersampling using the SMOTEENN algorithm. Next, you’ll compare two new machine learning models that reduce bias, BalancedRandomForestClassifier and EasyEnsembleClassifier, to predict credit risk. Once you’re done, you’ll evaluate the performance of these models and make a written recommendation on whether they should be used to predict credit risk.

Results:

The results for the six machine learning models are shown below:

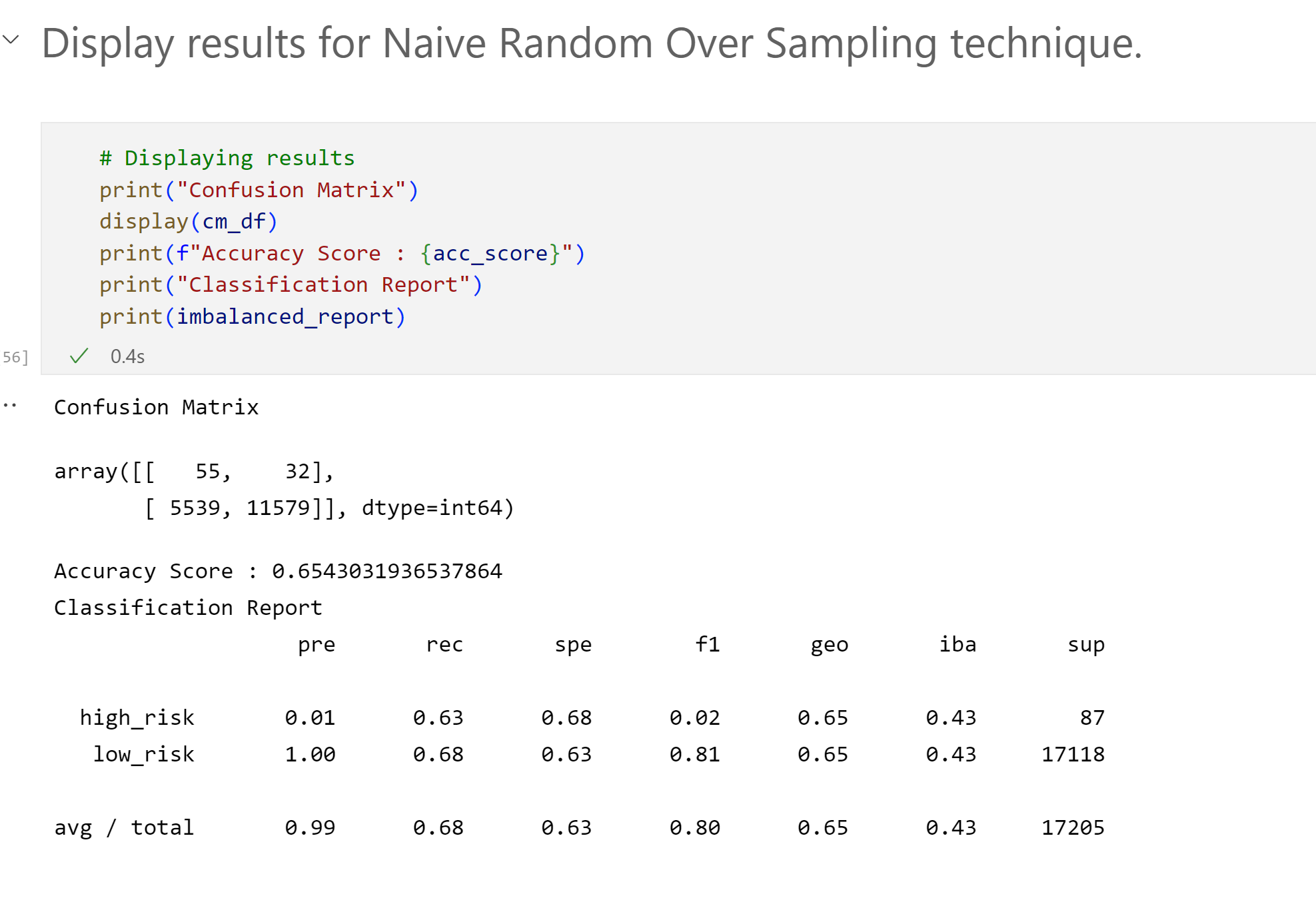

Naive Random Oversampling

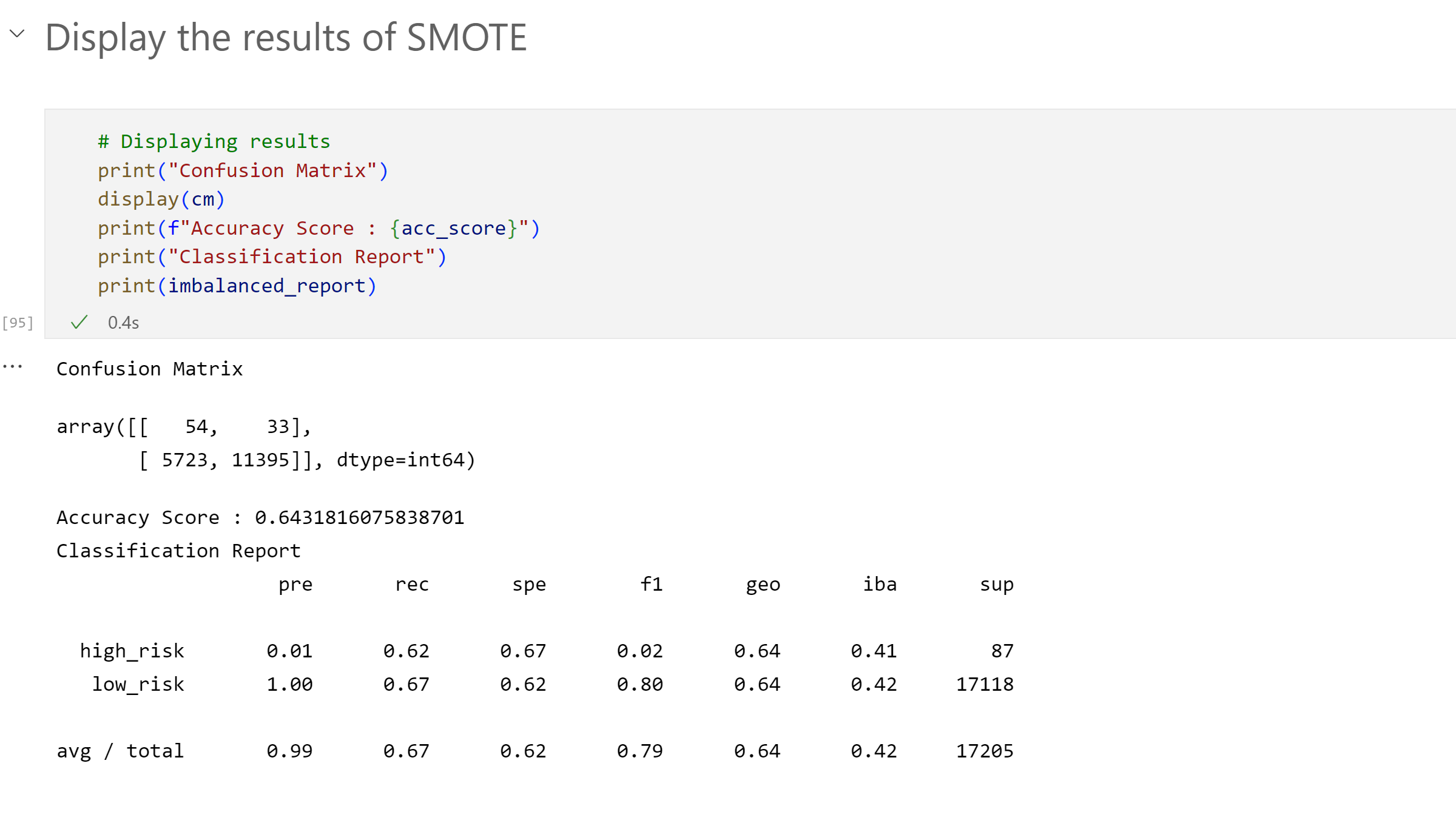

SMOTE Oversampling

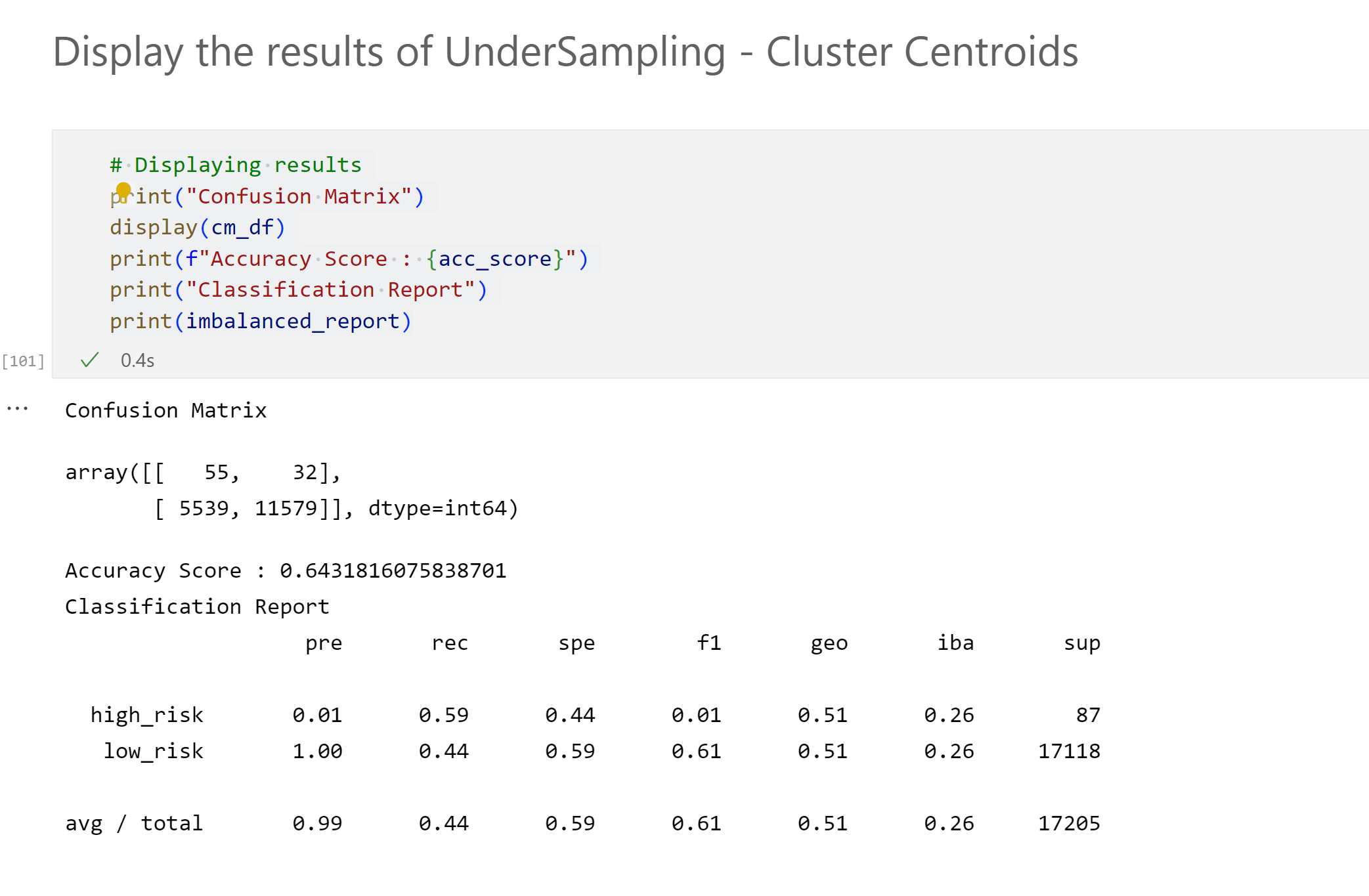

Cluster Centroids Undersampling

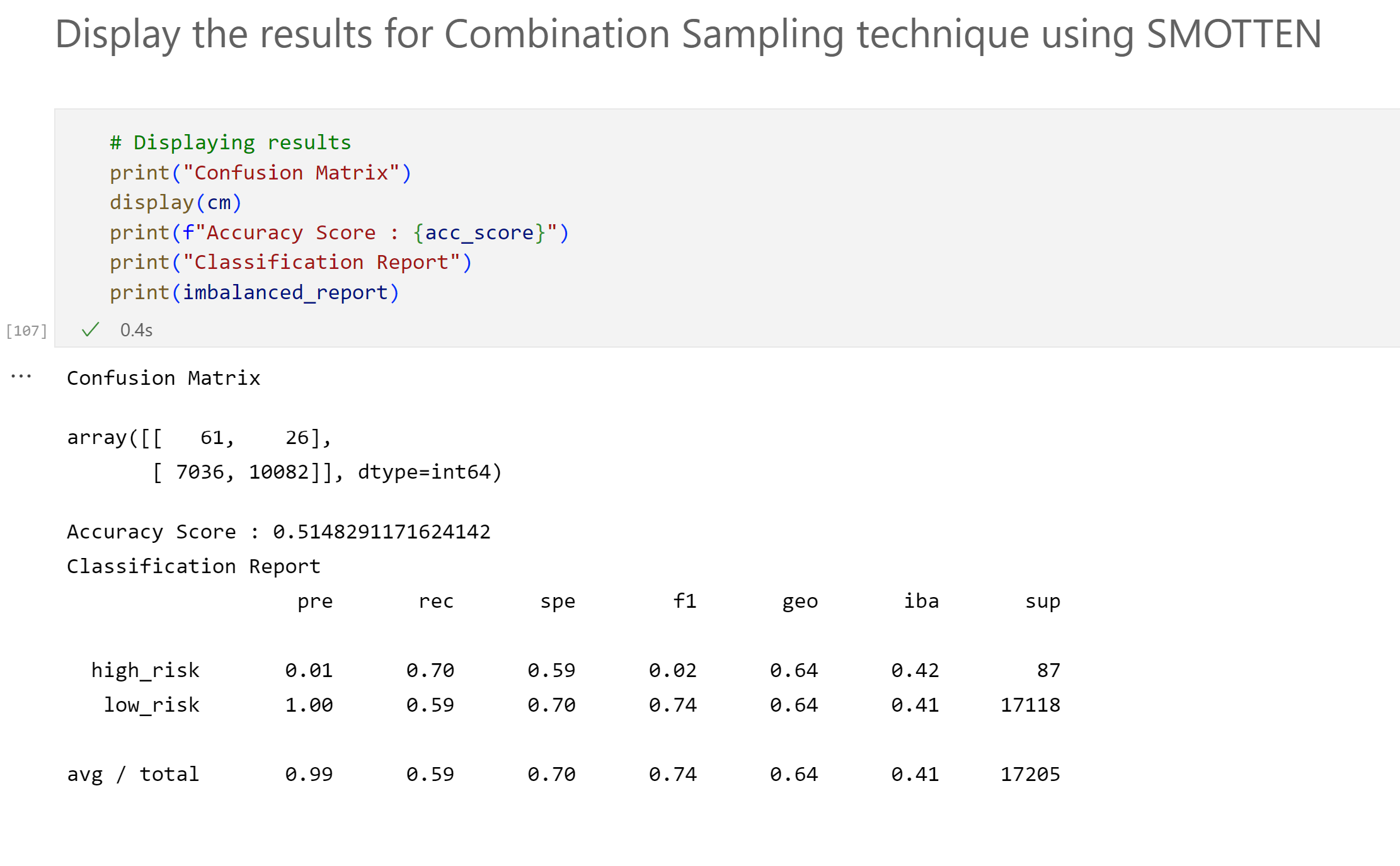

Combination Under-Over Sampling

Balanced Random Forest Classifier

Easy Ensemble AdaBoost Classifier

Summary:

All the models bal accuracy score, precision, recall are with in ranges between 0 and 1. The model that is close to 1 is considered to be best ML model.

For the Lending Club Credit card dataset, the Easy Ensemble AdaBoost Classifier is the best model with its .93 balanced accuracy.So I would start any further analysis with this model.

After looking into the classification report for imbalanced dataset The Easy Ensemble AdaBoost Classifier has the highest recall score, making it best machine learning model.